Newfront

Founded Year

2017Stage

Series D | AliveTotal Raised

$300.53MValuation

$0000Last Raised

$200M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-77 points in the past 30 days

About Newfront

Newfront operates as an insurance brokerage firm specializing in business insurance and risk management services. The company offers a range of products including casualty, cyber risk, executive risk, property, workers’ compensation, and surety, as well as services like global insurance, risk analytics, claims advocacy, and contract review. Newfront also provides employee benefits packages and retirement planning services. Newfront was formerly known as ABE Labs. It was founded in 2017 and is based in San Francisco, California.

Loading...

Newfront's Product Videos

Newfront's Products & Differentiators

Newfront Mobility

A Benefits Experience Platform

Loading...

Research containing Newfront

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Newfront in 6 CB Insights research briefs, most recently on Feb 23, 2024.

Feb 23, 2024

The B2C US insurtech market map

Jul 19, 2022 report

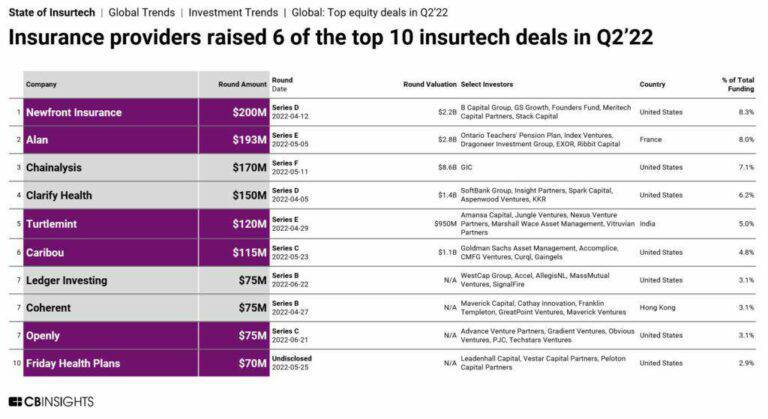

State of Fintech Q2’22 ReportExpert Collections containing Newfront

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Newfront is included in 5 Expert Collections, including Agriculture Technology (Agtech).

Agriculture Technology (Agtech)

2,159 items

Companies in the agtech space, such as equipment manufacturers, surveying drones, geospatial intelligence firms, and farm management platforms

Unicorns- Billion Dollar Startups

1,244 items

Insurtech

4,354 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,297 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Newfront Patents

Newfront has filed 3 patents.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/4/2013 | 4/16/2019 | Video signal, Broadcast engineering, Computer connectors, USB, Electronic test equipment | Grant |

Application Date | 3/4/2013 |

|---|---|

Grant Date | 4/16/2019 |

Title | |

Related Topics | Video signal, Broadcast engineering, Computer connectors, USB, Electronic test equipment |

Status | Grant |

Latest Newfront News

May 10, 2024

Share Insurance Business recently caught up with Shantelle Cabir (pictured), senior vice president and business insurance broker at California-based Newfront, to chat about the hurdles the sector faces and the outlook for construction insurance. IB: What do you think is the biggest challenge facing brokers in the construction space at the moment? Shantelle Cabir: One significant challenge for construction-focused brokers is the rising cost of property and auto insurance, leading to an increasingly hard market. Many clients are experiencing these costs affecting their bottom line, requiring brokers to navigate and find innovative solutions. Therefore, it's crucial to work with a broker with extensive industry reach and a strong ability to creatively structure insurance programs. IB: That makes sense. No matter what business you’re in, you’ve probably got to drive somewhere and you need to have a roof over your head. Cabir: Certainly, the impact of increasing rates is substantial, both in commercial and personal sectors, with California being notably affected. Even individuals with pristine records are experiencing rate hikes. This trend is exacerbated by legislative factors, posing challenges for many. In construction, the availability of builders' risk coverage is also being affected as we are continuously seeing carriers raise their minimums or leave the California entirely. This poses difficulties, especially for smaller contractors, who struggle to secure affordable coverage amidst rising costs. IB: Is builders’ risk facing issues in California for similar reasons as property insurance – because of climate-related risks, wildfires, things like that? Cabir: Builders' risk insurance in California presents distinct challenges, not solely attributable to climate-related risks like wildfires. Profitability concerns drive carriers' decisions, particularly regarding smaller projects where margins are slimmer. Additionally, emerging risks such as those stemming from homelessness contribute to insurers' caution. Contractors working with wood frames, operating in wildfire-prone regions, face heightened scrutiny. Legislative adjustments are needed to ensure insurers can price policies adequately, prompting some carriers to exit the market in search of more favorable conditions elsewhere. IB: That brings up a good question: there’s got to be a balance between insurers being able to turn a profit and the people that are insured and being able to afford the insurance. How do you find that balance? Cabir: I mean, that’s, that’s the million-dollar question. The current situation poses a significant conundrum. It underscores the pressing need for legislative reforms to address the challenges at hand. Without substantive changes, the trend of insurance companies exiting California will persist, further narrowing options for insurance purchasers in the marketplace. IB: What lines do you see thriving in 2024, and is construction going to be one of them? Or is that still going to face some challenges that might keep it subdued? Cabir: Different sectors within the construction industry are experiencing varied trajectories. Industrial construction continues to show promising growth, whereas the commercial and residential sectors face some significant draw backs, largely due to challenges in securing capital amidst high interest rates. We are seeing many projects being delayed to the end of 2024 or even the start of 2025. Many businesses are just looking to maintain their workforce and break even this year. The current election year further compounds uncertainties, with many executives adopting a cautious approach, awaiting political developments. However, irrespective of which side wins the election, I believe resilient companies with solid financial foundations, willingness to be flexible, and strategic planning are poised to weather these challenges. IB: What are some priorities you’d like to see the brokerage space or the construction insurance sector focus on right now? Cabir: I would like to see a greater emphasis on risk management, recognizing that its importance often gets diluted into a mere checkbox exercise for compliance purposes. True risk management comes from integration into the organizational culture, extending from top-level management to frontline workers. A pervasive commitment to safety and risk mitigation enhances the organization's overall performance. In the dynamic landscape of construction, achieving this integration can be very challenging, especially amidst employee turnover and growth trajectories. However, these challenges underscore the importance of investing in specialized expertise and leveraging collaborative partnerships through your broker and insurance carrier to enhance risk management practices throughout the organization. IB: So you think brokers should proactively work with the organizations that they serve to make sure their risk management strategies are sound? Cabir: As a company, it’s crucial to collaborate with a brokerage that believes in the structure of investing in risk management within their organization. While there are brokerages rely on third-party vendors for risk management, this approach often lacks full commitment. At Newfront, we differentiate ourselves by deploying dedicated, on-site risk managers who are Certified Safety Professionals (CSP). They work closely with our internal claims team and service teams to ensure comprehensive client representation and establish structured risk management protocols within the organization. This hands-on approach is especially vital in industries like construction, where practical experience is paramount. Having expert guidance throughout the process ensures optimal service delivery and facilitates informed decision-making for our clients. Have something to say about this story? Let us know in the comments below. Related Stories

Newfront Frequently Asked Questions (FAQ)

When was Newfront founded?

Newfront was founded in 2017.

Where is Newfront's headquarters?

Newfront's headquarters is located at 450 Sansome Street, San Francisco.

What is Newfront's latest funding round?

Newfront's latest funding round is Series D.

How much did Newfront raise?

Newfront raised a total of $300.53M.

Who are the investors of Newfront?

Investors of Newfront include Founders Fund, Meritech Capital Partners, B Capital, GS Growth, Stack Capital and 10 more.

Who are Newfront's competitors?

Competitors of Newfront include NFP, Risk Strategies, Hub International, USI, Acrisure and 7 more.

What products does Newfront offer?

Newfront's products include Newfront Mobility and 2 more.

Who are Newfront's customers?

Customers of Newfront include Twitter, AirBnB, Golden State Warriors, Coinbase and Zillow.

Loading...

Compare Newfront to Competitors

USI operates as an insurance brokerage and consulting firm. The company offers a range of services including property and casualty insurance, employee benefits, personal risk management, and retirement consulting solutions. USI primarily serves large risk management clients, middle market companies, smaller firms, and individuals with customized, actionable solutions. It was founded in 1994 and is based in Valhalla, New York.

BMS Group operates as an independent specialist brokerage. It focuses on providing solutions in the fields of reinsurance, wholesale, and direct insurance. The company offers a range of services including reinsurance solutions, wholesale insurance, direct insurance services, and capital advisory. BMS Group caters to various sectors including marine, energy, financial institutions, and construction, among others. It was founded in 1980 and is based in London, United Kingdom.

McGriff Insurance Services provides insurance and risk management solutions. The company offers a range of services including business insurance, risk management, employee benefits, and personal insurance solutions. McGriff caters to a diverse set of industries, offering specialized expertise to sectors such as agribusiness, construction, education, healthcare, and many others. It was founded in 1922 and is based in Raleigh, North Carolina.

INSURICA operates as an insurance agency with a focus on providing insurance and risk management solutions. The company offers a range of services including commercial insurance, employee benefits, personal insurance, and specialized programs for risk management, claims handling, and loss control. It caters to sectors such as construction, education, energy, healthcare, and many others, delivering industry-specific expertise and global insurance reach. It was founded in 1959 and is based in Oklahoma City, Oklahoma.

Alliant Insurance Services focuses on insurance, risk management, employee benefits, and consulting. The company offers a range of services including claims assistance, disaster preparedness and recovery, risk management solutions, and employee benefits. Alliant primarily serves sectors such as agribusiness, aviation, construction, cyber, energy and marine, financial institutions, healthcare, and real estate and hospitality among others. It was founded in 1925 and is based in Irvine, California.

AssuredPartners specializes in insurance brokerage and risk management within the insurance industry. The company offers various services such as commercial and personal insurance policies, risk management consulting, and employee benefits solutions. It serves various sectors including aerospace, agribusiness, construction, education, energy, government contracting, manufacturing, real estate, senior living, and transportation. The company was founded in 2011 and is based in Orlando, Florida.

Loading...