Dune Analytics

Founded Year

2018Stage

Series B | AliveTotal Raised

$79.42MValuation

$0000Last Raised

$69.42M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-9 points in the past 30 days

About Dune Analytics

Dune Analytics operates as a company focused on product analytics, specifically within the domain of decentralized applications (dApps) on the Ethereum blockchain. The company's main service involves providing analytics for these dApps, allowing users to understand and interpret data related to their products. It was founded in 2018 and is based in Oslo, Norway.

Loading...

ESPs containing Dune Analytics

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital assets market data & insights market provides comprehensive data and insights into blockchain networks, crypto markets, and decentralized finance. It empowers financial institutions with historical and real-time fundamental (on chain) and market data for research, trading, risk analytics, reporting, and compliance. The market is fragmented and lacks standardization, making it complex a…

Dune Analytics named as Challenger among 14 other companies, including TradingView, Coin Metrics, and Nansen.

Loading...

Research containing Dune Analytics

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Dune Analytics in 5 CB Insights research briefs, most recently on Feb 23, 2023.

Dec 14, 2022

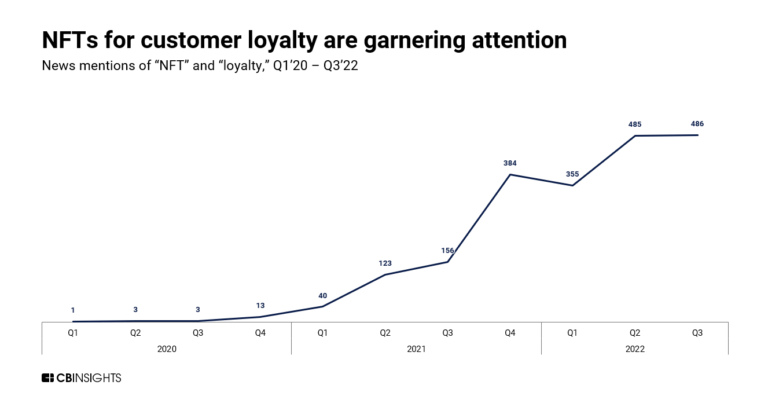

What L’Oréal, Nike, and LVMH are doing in Web3Expert Collections containing Dune Analytics

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

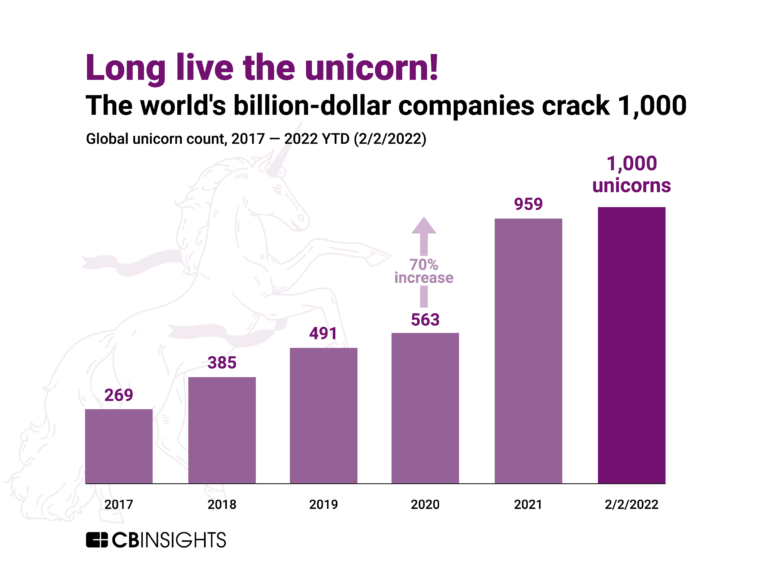

Dune Analytics is included in 3 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Blockchain

12,277 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Blockchain 50

50 items

Latest Dune Analytics News

Sep 13, 2024

Coinbase’s newly launched wrapped Bitcoin product, cbBTC, has seen rapid adoption within its first 24 hours, with a market capitalization nearing $100 million. Data from Dune Analytics shows the circulating supply of cbBTC has reached 1,720 tokens, valued at $99.8 million. Of this, 43% is on Base, while 57% resides on Ethereum . Coinbase cbBTC Supply (Source: Dune Analytics) Base’s DeFi growth Industry analysts have noted that Coinbase’s cbBTC growth could significantly boost DeFi activities on the exchange’s layer-2 network, Base. Luke Youngblood, a contributor to Moonwell DeFi, highlighted the product’s impact. He pointed out that cbBTC’s fungibility with Bitcoin on Coinbase would enable retail BTC holdings exceeding $20 billion and institutional holdings over $200 billion to seamlessly integrate with Base’s on-chain ecosystem. Nansen CEO Alex Alealso praised the token’s rapid adoption and predicted that it would substantially increase total assets on the Base network. Further, He shared that Coinbase currently holds about 36% of the supply, while market maker Wintermute ranks among the top holders. Svanevik remarked : “[It appears] Wintermute is the #1 market maker. [It will] be a solid business for them.” Sun FUDs cbBTC Despite cbBTC’s early success, not everyone is optimistic. TRON founder Justin Sun voiced skepticism, dubbing cbBTC “central bank BTC” due to its lack of Proof of Reserve audits and potential government intervention. He stated: “cbbtc lacks Proof of Reserve, no audits, and can freeze anyone’s balance anytime. Essentially, it’s just ‘trust me.’ Any US government subpoena could seize all your BTC. There’s no better representation of central bank Bitcoin than this. It’s a dark day for BTC.” Sun further claimed that integrating cbBTC into DeFi could introduce security risks, as government subpoenas could instantly freeze on-chain Bitcoin, undermining decentralization. He said : “I’m friends with many DeFi protocol founders, but integrating cbbtc will pose major security risks to decentralized finance. A single government subpoena could freeze on-chain Bitcoin instantly, making decentralization a joke.” Some have suggested Sun’s criticisms may stem from concerns that Coinbase’s cbBTC could encroach on the market share of BitGo’s WBTC —a project with which Sun has ties. Notably, his involvement with WBTC has sparked debate within the crypto community, as some now seek alternatives. Mentioned in this article

Dune Analytics Frequently Asked Questions (FAQ)

When was Dune Analytics founded?

Dune Analytics was founded in 2018.

Where is Dune Analytics's headquarters?

Dune Analytics's headquarters is located at Toyen, Oslo.

What is Dune Analytics's latest funding round?

Dune Analytics's latest funding round is Series B.

How much did Dune Analytics raise?

Dune Analytics raised a total of $79.42M.

Who are the investors of Dune Analytics?

Investors of Dune Analytics include Dragonfly, Multicoin Capital, Coatue, Union Square Ventures, Redpoint Ventures and 10 more.

Who are Dune Analytics's competitors?

Competitors of Dune Analytics include RedStone and 6 more.

Loading...

Compare Dune Analytics to Competitors

Glassnode is a leading blockchain data and intelligence platform operating in the digital asset markets. The company provides a wide range of services including on-chain and financial market data analysis, wallet tracking, exchange data coverage, and market research. Their primary customers are institutions and individuals involved in trading, risk management, and research within the digital asset markets. It was founded in 2017 and is based in Zug, Switzerland.

Nansen is a blockchain analytics platform focused on providing insights for crypto investors and teams. The company offers services such as enrichment of onchain data with wallet labels, real-time dashboards for tracking assets, and smart alerts for market movements. Nansen primarily serves sectors such as crypto investors, venture capital, exchanges, and DeFi protocols. It was founded in 2020 and is based in Singapore, Singapore.

Riskbloq is a company focused on providing professional risk analysis and scoring for digital assets within the cryptocurrency sector. Their main services include generating comprehensive risk profiles for over 3000 crypto assets by combining on-chain and off-chain data, aimed at aiding investors in making informed crypto investment decisions. The company primarily caters to individual and institutional investors looking for data-driven insights into the cryptocurrency market. It was founded in 2022 and is based in Johannesburg, South Africa.

DeepDAO lists, ranks, and analyzes top DAOs across multiple metrics, such as membership and assets under management (AUM). Its mission is to provide comprehensive discoverability for decentralized governance systems, analytics, and information gathering.

IntoTheBlock provides specialized knowledge and advanced technology in the cryptocurrency market. The company provides impartial and meaningful information about digital assets, primarily through data, innovation, and knowledge. It was founded in 2018 and is based in Miami, Florida.

Chainalysis is a blockchain data platform that operates in the cryptocurrency sector, providing insights and analytics to support various industries. The company offers solutions for crypto investigations, regulatory compliance, and market intelligence, enabling businesses, financial institutions, and government agencies to engage with digital assets securely and effectively. Chainalysis primarily serves law enforcement agencies, financial institutions, and regulatory bodies seeking to understand and leverage blockchain technology for security and compliance purposes. It was founded in 2014 and is based in New York, New York.

Loading...