Paxos

Founded Year

2012Stage

Corporate Minority | AliveTotal Raised

$535.25MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-64 points in the past 30 days

About Paxos

Paxos specializes in regulated blockchain infrastructure and financial solutions within the financial services sector. The company offers a suite of services including crypto brokerage, stablecoin issuance, and tokenization infrastructure for assets like gold. Paxos primarily serves enterprises in the financial services industry, providing technology that enables them to launch innovative blockchain and digital asset solutions. It was founded in 2012 and is based in New York, New York.

Loading...

ESPs containing Paxos

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

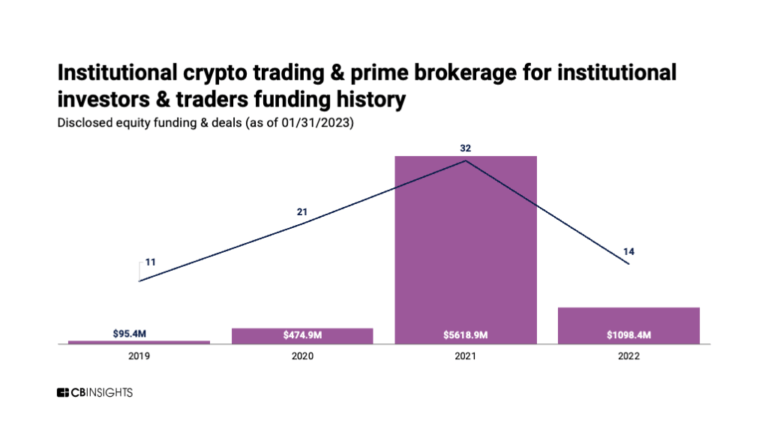

The institutional crypto trading & prime brokerage market is a complex and fragmented market that requires secure and reliable platforms to manage the operational complexity, security, and scale of trading cryptocurrencies. Vendors in this market offer built-in-house proprietary solutions that promise to combine prime brokerage, trade execution, and custody seamlessly. The market aims to unlock th…

Paxos named as Challenger among 15 other companies, including Coinbase, BitGo, and HTX.

Loading...

Research containing Paxos

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Paxos in 8 CB Insights research briefs, most recently on Feb 23, 2023.

Expert Collections containing Paxos

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Paxos is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Blockchain

11,088 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Capital Markets Tech

1,118 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Fintech

9,294 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

100 items

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Paxos Patents

Paxos has filed 4 patents.

The 3 most popular patent topics include:

- bearings (mechanical)

- computer connectors

- mains power connectors

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

2/25/2022 | 8/15/2023 | Mains power connectors, Tires, Bearings (mechanical), Computer connectors, Telephone connectors | Grant |

Application Date | 2/25/2022 |

|---|---|

Grant Date | 8/15/2023 |

Title | |

Related Topics | Mains power connectors, Tires, Bearings (mechanical), Computer connectors, Telephone connectors |

Status | Grant |

Latest Paxos News

Sep 20, 2024

Share This Article Founded by Former Coinbase, Circle, and Goldman Sachs Senior Leaders, First-of-its-Kind Crypto Exchange Launches with PayPal USD (PYUSD) as its preferred stablecoin Funding Round Includes Participation from RRE Ventures, Reciprocal Ventures, Paxos, Accomplice Blockchain, Hack VC, Solana Foundation, and Aptos NEW YORK, September 18, 2024-- TrueX, a non-custodial, stablecoin-native exchange representing the next evolution in crypto markets, today announced that it has officially launched out of stealth. TrueX is the flagship product of True Markets, a platform dedicated to offering markets and liquidity as a service globally through reliable, innovative trading technology. Founded by Vishal Gupta and Patrick McCreary, formerly of Coinbase, Circle, and Goldman Sachs, TrueX is built by a team experienced in developing stablecoins, lending, and exchange infrastructure. TrueX’s advanced trading platform features a proprietary matching engine, the security of segregated execution and custody, and seamless stablecoin settlement. The exchange is working with Paxos, which provides leading blockchain infrastructure and regulated custodial services, to utilize PayPal USD as the default settlement currency. This will facilitate seamless stablecoin settlement with the security and efficiency that customers expect. In conjunction with its launch, TrueX has secured $9 million in seed funding from a prestigious group of investors, including RRE Ventures, Reciprocal Ventures, Paxos, Accomplice Blockchain, Hack VC, Solana Foundation, and Aptos. “Throughout the natural evolution of crypto markets, we've seen opportunities to make exchanges safer and more trusted,” said Vishal Gupta, Co-Founder and Chief Executive Officer of TrueX. “Clients now demand the security of true segregation of execution and custody. Our team has worked diligently to meet these needs, leveraging the power of stablecoins to facilitate efficient liquidity and settlement solutions. With the support of our talented team and committed investors, we are proud to unveil a next-generation platform that redefines trader expectations.” Prior to founding TrueX, Vishal Gupta was the Head of Exchange at Coinbase, where he helped oversee the development, product vision, and strategy of the largest exchange operating in the U.S., including the launch of the Coinbase International Exchange, which trades perpetual futures for clients outside of the U.S. Prior to that, he served as Head of USDC at Circle, where he oversaw the launch and exponential growth of USDC, the largest U.S.-domiciled stablecoin. He has also served as Head of Execution at Volant Execution – the execution business of Volant Trading – and as Vice President and Head of U.S. Listed Options at Goldman Sachs. Patrick McCreary previously served as a senior staff engineer at Coinbase, where he was one of the key architects and technical leaders of the Coinbase International Exchange business, overseeing U.S. exchange enhancements trading billions in USD volume per day. Patrick also held senior roles at Volant Execution and Goldman Sachs. "With increasing institutional adoption of crypto assets, these market participants need a trusted venue that prioritizes transparency, execution quality, and asset protection," said Craig Burel, General Partner at Reciprocal Ventures. "TrueX's non-custodial platform and ultra low-latency matching engine represent a critical improvement that will drive crypto capital markets forward. Under the visionary leadership of Vishal and Patrick, TrueX is poised to become a force in crypto markets and trading." Walter Hessert, Head of Strategy at Paxos, stated, "With its groundbreaking non-custodial model, strong leadership team and commitment to transparency, we believe that TrueX is well positioned to succeed in the market. We're excited to support TrueX and celebrate this launch as an investor and infrastructure provider." Coinciding with the launch, TrueX is also pioneering its Liquidity Program, which aims to reward and incentivize market participants. The program is open to all institutional clients who will be able to gain discounted taker fees and preferred maker fees. To celebrate the launch, clients in the program can also participate in the company’s success through an equity competition for up to $1 million USD of company equity to top volume traders (details on TrueX website listed below). To learn more about TrueX and join its community, visit https://truex.co/ and follow us on https://x.com/truex_exchange. About True Markets True Markets is a cryptocurrency platform dedicated to offering markets and liquidity as a service globally through reliable, innovative trading technology. True Markets’ flagship product, TrueX, is a first-of-its-kind non-custodial, stablecoin-native crypto exchange that partners with Paxos to enable seamless stablecoin settlement and ensure unmatched security and efficiency. True Markets was founded in 2024 by Vishal Gupta and Patrick McCreary, formerly of Coinbase, Circle, and Goldman Sachs and key architects of the Coinbase International Exchange business. To learn more, please visit https://truex.co/ or email info@truex.co. Contact:

Paxos Frequently Asked Questions (FAQ)

When was Paxos founded?

Paxos was founded in 2012.

Where is Paxos's headquarters?

Paxos's headquarters is located at 450 Lexington Avenue, New York.

What is Paxos's latest funding round?

Paxos's latest funding round is Corporate Minority.

How much did Paxos raise?

Paxos raised a total of $535.25M.

Who are the investors of Paxos?

Investors of Paxos include Mercado Libre Fund, Liberty City Ventures, Declaration Partners, Senator Investment Group, Mithril Capital Management and 21 more.

Who are Paxos's competitors?

Competitors of Paxos include Tassat, STACS, Blockstream, Polysign, Zero Hash and 7 more.

Loading...

Compare Paxos to Competitors

Zero Hash is a B2B2C embedded infrastructure platform specializing in digital asset integration for various businesses within the financial technology sector. The company provides API-first technology and regulatory infrastructure to enable platforms to offer digital asset trading, custody, crypto-backed rewards, and payment solutions. Zero Hash primarily serves neo-banks, broker-dealers, payment groups, and other financial service firms looking to incorporate digital assets into their offerings. It was founded in 2017 and is based in Chicago, Illinois. Zero Hash operates as a subsidiary of Bittrex.

BurjX facilitates cryptocurrency trading exchange and broker-dealer solutions. The company develops a platform for trading digital assets, managing digital asset wallets, and facilitating financial transactions. It was founded in 2022 and is based in Abu Dhabi, United Arab Emirates.

Fireblocks is an enterprise-grade platform specializing in secure infrastructure for moving, storing, and issuing digital assets within the blockchain and cryptocurrency sectors. The company offers a suite of applications for digital asset operations management and a comprehensive development platform for building blockchain-based businesses. Fireblocks' solutions cater to a variety of sectors including financial institutions, exchanges, and fintech startups. It was founded in 2018 and is based in New York, New York.

HydraX is a company that focuses on digital capital markets infrastructure within the technology sector. The company offers a range of services including token management, exchange solutions, digital self-custody solutions, and regulated broker-dealer services, all aimed at streamlining trading processes and encouraging interoperability between all asset classes. HydraX primarily serves sectors such as commodities trading firms, banks and financial institutions, digital exchanges and OTC marketplaces, and crypto exchanges. It was founded in 2018 and is based in Singapore.

FalconX focuses on providing a platform for institutional cryptocurrency trading. The company offers a range of services including trade execution, credit and treasury management, and market making, all aimed at simplifying the complex landscape of digital assets. Its services primarily cater to the financial institutions sector. It was founded in 2018 and is based in San Mateo, California.

BitGo focuses on providing secure and solutions for the digital asset economy. The company offers a range of services including regulated custody, financial services, and core infrastructure. BitGo primarily serves investors and builders in the digital asset economy, including exchanges, retail platforms, crypto-native firms, and institutional investors. It was founded in 2013 and is based in Palo Alto, California.

Loading...