Pipe

Founded Year

2019Stage

Line of Credit | AliveTotal Raised

$478.12MLast Raised

$100M | 3 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-29 points in the past 30 days

About Pipe

Pipe provides financial services specializing in non-dilutive capital solutions for businesses. It offers a modern capital platform that allows entrepreneurs to access funding based on their revenue, with payment terms. It primarily serves the financial needs of small to mid-size businesses and entrepreneurs seeking growth without equity dilution. It was formerly known as Third Base Pipe. The company was founded in 2019 and is based in San Francisco, California.

Loading...

ESPs containing Pipe

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The lending APIs & infrastructure market provides end-to-end solutions for lending operations, including loan management systems, risk management tools, and compliance management capabilities. The market for lending APIs and infrastructure is driven by factors such as increasing demand for digital lending platforms, the need for improved efficiency and automation in lending operations, and the gro…

Pipe named as Challenger among 15 other companies, including Mambu, Q2, and Plaid.

Pipe's Products & Differentiators

Embedded Capital

Pipe Capital makes it easy for payfacs and vertical software providers to launch a turnkey capital product quickly inside the software their customers use every day. Our APIs streamline the embedding process, and our underwriting, based on live partner data, simplifies merchant applications to just a few clicks. Merchants pay one flat, transparent fee, added to the principal, and paid back over time as a percentage of revenue. Payments flex with their sales cycle, so they’re never stuck with a fixed payment if sales are down. For partners, we operate on a revenue share model based on negotiated percentage points of the entire advance.

Loading...

Research containing Pipe

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Pipe in 3 CB Insights research briefs, most recently on May 8, 2024.

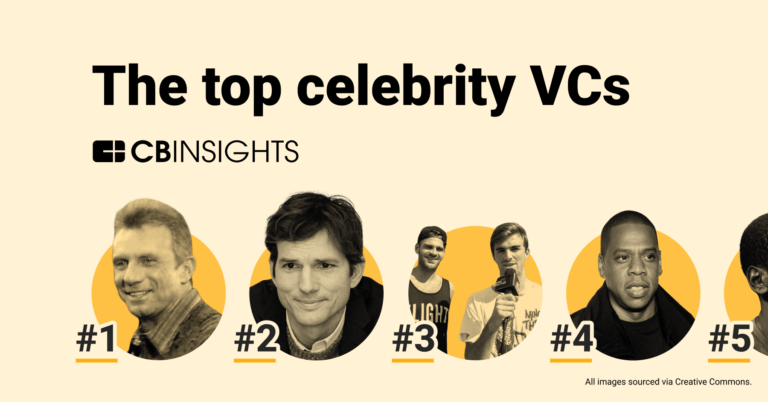

May 8, 2024

The embedded banking & payments market map

Feb 28, 2024 report

The Celebrity VC IndexExpert Collections containing Pipe

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Pipe is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Digital Lending

2,273 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

SMB Fintech

1,586 items

Fintech

9,295 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Pipe Patents

Pipe has filed 61 patents.

The 3 most popular patent topics include:

- piping

- plumbing

- catheters

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/8/2023 | 7/2/2024 | Hazardous air pollutants, Plumbing, Environmental engineering, Sewerage, Piping | Grant |

Application Date | 3/8/2023 |

|---|---|

Grant Date | 7/2/2024 |

Title | |

Related Topics | Hazardous air pollutants, Plumbing, Environmental engineering, Sewerage, Piping |

Status | Grant |

Latest Pipe News

Jul 30, 2024

? After leading roles at Intuit and Square, Luke Voiles is shaking up the business financing space with exciting embedded capital platform Pipe. In this insightful interview, CEO Voiles speaks to Ali Paterson about Pipe’s embedded financial services product, aimed at bypassing traditional, cumbersome funding methods. We get his thoughts on the increase in sector specific software solutions and why he’s passionate about supporting small businesses. There’s some exciting plans in the ‘Pipe-line’ too. Hear about all this and more in this FF Virtual Arena profile. The funding evolution To explain what Pipe really offers we first need some context and Voiles helps with this. He goes through the evolution of funding for small and medium-sized businesses (SMBs), contrasting traditional methods with Pipe’s innovative approach. Traditionally, securing funding required businesses to present two years of audited financial statements and tax returns to banks, a process that was lengthy and required a proven history of consistent performance. This method, exemplified by SBA loans, made it difficult for newer or smaller businesses to access necessary capital, something he’s very passionate about, given his heritage. His dad was a small business owner himself, and this along with the experiences that many small businesses faced during the pandemic has been a big part of why he’s taken this role. We’ve seen numerous evolutions in funding since those days and more recently, companies like Square Capital, Stripe Capital, and PayPal Working Capital, have focused on single cash flow streams. By simplifying the problem to a narrow set of financial data, these companies could provide more streamlined and accessible funding solutions. According to Voiles, Pipe builds on this evolution by allowing any SaaS business to offer similar financial services to their customers, thereby democratizing access to capital. The changing business landscape Voiles also highlights a broader shift in how SMBs operate, noting that business owners no longer visit banks regularly. Instead many rely on specialized vertical software that addresses specific industry needs comprehensively. Examples include Slice for pizza shops and Boulevard for nail and hair salons, which offer end-to-end solutions tailored to their respective industries. Pipe has capitalised on this shift by embedding financial services within these vertical software solutions. This approach allows businesses to access necessary financial products without navigating complex regulatory and financial risks. It’s perfect timing, and a super nifty product. It’s designed to keep the balance sheet light, offloading risk by selling whole loans to capital markets. Voiles says this approach enables unlimited scaling potential. Pipe’s multi-draw line of credit is particularly attractive to SMBs, offering a security blanket that meets their needs without the onerous terms often found in traditional financing products. Future plans Of course, we want to know what’s next for this exciting company. Looking forward, Pipe will expand. In addition to its capital products, they’re developing a card product for micro-merchants, which will be a 30-day charge card powered by Pipe’s risk engine. This product aims to fill a gap in the market, as existing solutions like those from Capital One and Amex do not cater to micro-merchants due to the high perceived risk. Pipe’s approach leverages cash flow data from POS terminals, enabling it to extend credit without personal guarantees or FICO-based underwriting. Not only that but they also plan to introduce spend management and payroll services, fully embeddable within partner platforms. These additions will streamline expense management for SMBs, allowing them to focus more on their core operations. Of course AI gets a mention, as it often does these days, with Voiles hinting at a “moonshot” project involving an AI sidekick, which would automate business tasks and decision-making based on verticalized data sets. It’s a really interesting profile piece of a passionate fintech leader who is behind a product that could revolutionize the capital space and have a genuinely positive impact on small businesses. Be sure to watch more of our Virtual Arenas on our website. People In This Post Virtual Arena News News Funding Fintech

Pipe Frequently Asked Questions (FAQ)

When was Pipe founded?

Pipe was founded in 2019.

Where is Pipe's headquarters?

Pipe's headquarters is located at 548 Market Street, San Francisco.

What is Pipe's latest funding round?

Pipe's latest funding round is Line of Credit.

How much did Pipe raise?

Pipe raised a total of $478.12M.

Who are the investors of Pipe?

Investors of Pipe include Victory Park Capital, BBQ Capital, Mindrock Capital, Zain Ventures, MaC Venture Capital and 39 more.

Who are Pipe's competitors?

Competitors of Pipe include Parafin, Yoii, re:cap, Braavo Capital, Capchase and 7 more.

What products does Pipe offer?

Pipe's products include Embedded Capital and 1 more.

Who are Pipe's customers?

Customers of Pipe include Boulevard and Priority.

Loading...

Compare Pipe to Competitors

Clearco e-commerce investor providing equity-free capital solutions to e-commerce businesses. It provides growth capital to web-enabled firms using business data instead of a personal credit score. It was formerly known as Clearbanc. The company was founded in 2015 and is based in Toronto, Canada.

Vitt focuses on investment management. The company offers services that allow customers to invest their idle cash in Money Market Funds. These funds are managed by Goldman Sachs Asset Management and are held with a Financial Conduct Authority-regulated custodian, mitigating counterparty risk. It was founded in 2021 and is based in London, United Kingdom.

Capchase specializes in providing non-dilutive growth financing and payment solutions within the SaaS industry. The company offers revenue-based capital to help SaaS companies grow and scale, SaaS split payments to facilitate deal closures, and automated invoice collection to streamline cash flow management. Capchase primarily serves the SaaS industry, offering financial tools designed to accelerate sales, improve cash flow, and support customer acquisition. It was founded in 2020 and is based in New York, New York.

Uncapped specializes in providing non-dilutive working capital financing to growing brands and online retailers. The company offers flexible financial solutions enabling businesses to fund inventory, marketing, and other growth-related expenses without giving up equity. Uncapped primarily serves the e-commerce industry, offering services to brands and retailers with a proven track record of sales and growth. It was founded in 2019 and is based in London, United Kingdom.

Levenue is a platform focused on providing financial services in the business sector. The company offers a service that allows businesses with recurring revenue to access funding without dilution of shares. It primarily serves businesses in need of non-dilutive financing to accelerate their growth. It was founded in 2021 and is based in Breda, Netherlands.

Founderpath is a financial services company that operates in the Software as a Service (SaaS) industry. The company provides funding solutions for SaaS founders, offering services that allow them to track customer and business metrics, get their business valuation, and secure capital without selling equity. Primarily, Founderpath caters to the needs of the SaaS industry. Founderpath was formerly known as Operation Pie. It was founded in 2019 and is based in Austin, Texas.

Loading...