Rappi

Founded Year

2015Stage

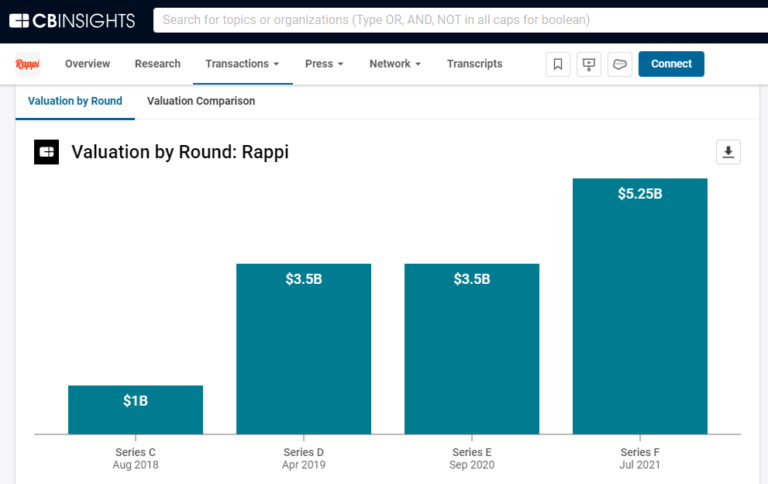

Convertible Note | AliveTotal Raised

$2.249BLast Raised

$100K | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-45 points in the past 30 days

About Rappi

Rappi operates as a tech company focusing on digital commerce and delivery services. The company offers a platform for ordering food, supermarket goods, and pharmacy products online, with a delivery service to customers' locations. Rappi partners with restaurants and stores to facilitate their access to a wider customer base through its app. It was founded in 2015 and is based in Mexico City, Mexico.

Loading...

ESPs containing Rappi

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The on-demand restaurant delivery market facilitates flexible delivery of restaurant meals to customers using a mobile application or website. These services enable restaurants to deliver food directly to customers’ doorsteps. Common features for customers include order tracking, the ability to see customer reviews, and the ability to select from various restaurants.

Rappi named as Leader among 15 other companies, including Uber, DoorDash, and Deliveroo.

Loading...

Research containing Rappi

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Rappi in 7 CB Insights research briefs, most recently on Jan 3, 2024.

Jan 3, 2024

2024 prediction: Rappi acquires Jokr

Oct 10, 2023 report

The most active startup accelerators and where they’re investing

Expert Collections containing Rappi

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Rappi is included in 6 Expert Collections, including Supply Chain & Logistics Tech.

Supply Chain & Logistics Tech

5,403 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,244 items

On-Demand

1,244 items

Food & Meal Delivery

1,531 items

Startups and tech companies offering online grocery, food, beverage, and meal delivery services.

Fintech

13,396 items

Excludes US-based companies

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Latest Rappi News

Sep 18, 2024

News provided by Share this article Share toX NEW YORK, Sept. 18, 2024 /PRNewswire/ -- Report with market evolution powered by AI- The global online on-demand food delivery services market size is estimated to grow by USD 559.2 billion from 2024-2028, according to Technavio. The market is estimated to grow at a CAGR of 34.65% during the forecast period. Increasing partnerships between restaurants and online food delivery aggregators is driving market growth, with a trend towards growing prominence of technology and iot devices. However, growing threat from direct delivery services offered by restaurants poses a challenge. Ltd., Curefoods India Pvt. Ltd., Delivery Hero SE, Dominos Pizza Inc., DoorDash Inc., Dunzo Digital Pvt. Ltd., EatSure, Glovoapp23 SL, Grab Holdings Ltd., Grubhub Inc., HelloFood, HungryPanda Ltd., Just Eat Takeaway.com, Meituan Dianping, Movile, Rappi Inc., Talabat, Uber Technologies Inc., and Zomato Media Pvt. Ltd.. Technavio has announced its latest market research report titled Global online on-demand food delivery services market 2024-2028 Key insights into market evolution with AI-powered analysis. Explore trends, segmentation, and growth drivers- View the snapshot of this report Online On-Demand Food Delivery Services Market Scope Report Coverage Key companies profiled Alibaba Group Holding Ltd., Bundl Technologies Pvt. Ltd., Curefoods India Pvt. Ltd., Delivery Hero SE, Dominos Pizza Inc., DoorDash Inc., Dunzo Digital Pvt. Ltd., EatSure, Glovoapp23 SL, Grab Holdings Ltd., Grubhub Inc., HelloFood, HungryPanda Ltd., Just Eat Takeaway.com, Meituan Dianping, Movile, Rappi Inc., Talabat, Uber Technologies Inc., and Zomato Media Pvt. Ltd. Market Driver Vendors in the global online on-demand food delivery services market are enhancing their businesses through technology investments. This includes expanding customer bases, developing infrastructure, and training personnel. Notably, restaurants and food delivery services are prioritizing cross-platform ordering capabilities for customer convenience. In the US, Dominos Anyware showcases this trend, enabling orders through IoT devices like smart TVs, smartwatches, and connected cars. Technology, particularly IoT, is poised to significantly impact the market during the forecast period. The Online On-Demand Food Delivery Services market is experiencing significant growth due to increased smartphone penetration and internet connectivity. AI-driven recommendations, order tracking, and personalized options are trending features. Healthier, sustainable meal options, plant-based foods, organic foods, pet food, grocery, alcohol, and meal delivery are expanding categories. Dark kitchens and virtual kitchens are emerging business models. Uber Eats Japan, Cartken, Mitsubishi Electric, DoorDash, and shipping services are major players. Volume of orders is high in urban markets, driven by millennials and tech giants. Competitive prices, discounts, and customer loyalty programs are key strategies. Venture capital and strategic maneuvers are shaping consolidation. Historic period shows continued growth from 2010s to present, with payment methods evolving from cardboard boxes to online portals. Ready-to-eat food and restaurant-to-customer models are also gaining traction. Request Sample of our comprehensive report now to stay ahead in the AI-driven market evolution! Market Challenges Several restaurants are taking control of their online food delivery operations to manage branding, quality, safety, and hygiene directly. This shift allows for a more engaged customer relationship and potential cost savings from avoiding third-party delivery service commissions. Additionally, direct orders can lead to shorter delivery times and streamlined payment processes, enhancing brand loyalty. However, this trend may challenge the growth of the global online on-demand food delivery services market, as restaurants handle increasing order volumes themselves. In the historic period of the 21st century, online on-demand food delivery services have revolutionized the way we order and consume ready-to-eat food. The platform connects restaurants to customers through an online portal, enabling seamless ordering and payment methods. Internet penetration and smartphone usage have fueled this growth, with tech giants like Amazon, Uber, and Grubhub leading the charge. Challenges in this market include last-mile connectivity, meal delivery times, and restaurant review. Shipping services must ensure timely delivery using ecommerce delivery solutions and optimizing last-mile connectivity. Virtual kitchens, cloud kitchens, and ghost kitchens have emerged to cater to the increasing demand for online food sales. Millennials, with their preference for convenience and innovation, have driven the market. Servicing personnel, instore merchandising, and order processing systems have become essential components of the business model. Packaged food services, POS systems, and digital menu boards have also become crucial. Food preferences, sales trends, and order processing times are essential factors for restaurants to consider. DemandSage and other aggregators help restaurants manage their online sales and customer preferences. Robot food delivery and cardboard boxes are the latest innovations in the industry, addressing the need for contactless delivery and sustainable packaging. Insurance, furnishing, and meal delivery volumes are other areas of focus for businesses in this sector. Segment Overview Business Segment 3.5 South America 1.1 Order-focused food delivery services- Online on-demand food delivery services have become increasingly popular, offering customers the convenience of ordering meals from their preferred restaurants and having them delivered right to their doorstep. These services use advanced technology to facilitate seamless ordering, real-time tracking, and contactless delivery, making them a reliable solution for busy individuals and families. The market for online food delivery is growing rapidly, with companies investing in expanding their offerings, improving logistics, and enhancing the customer experience. By providing a convenient and efficient solution for meal preparation and delivery, these services have become an essential part of modern life. Download a Sample of our comprehensive report today to discover how AI-driven innovations are reshaping competitive dynamics Research Analysis The Online On-Demand Food Delivery Services Market is a rapidly growing industry that caters to the increasing demand for convenience and flexibility in meal consumption. Virtual kitchens and cloud kitchens have emerged as key players in this market, focusing solely on preparing meals for delivery orders. Millennials, with their preference for technology and convenience, are a significant consumer base. The market utilizes cardboard boxes and insulated bags for delivery, ensuring the food stays fresh during transit. Aggregators and ecommerce delivery platforms facilitate online sales, with last-mile connectivity ensuring timely delivery. Smartphones and mobile devices have become essential tools for order processing and digital menu boards. Robot food delivery and meal delivery times are innovations that aim to further streamline the process. Customer preferences and sales trends shape the menu offerings, while order processing systems and restaurant reviews help maintain quality. Insurance, servicing personnel, and furnishing are other important considerations for players in this market. Food preferences and delivery volumes continue to shape the industry, with virtual restaurants and ghost kitchens gaining popularity in urban markets. Market Research Overview The Online On-Demand Food Delivery Services market has seen significant growth in the historic period, driven by the increasing penetration of the internet and smartphone usage. This platform-to-customer model allows ready-to-eat food to be ordered online from restaurants or virtual kitchens and delivered to customers' doors. Payment methods have evolved, with tech giants integrating e-wallets and other digital payment systems. Urban markets, particularly in developed countries, have seen high demand for food delivery services, with aggregators and e-commerce delivery companies servicing millions of orders per day. Last-mile connectivity and the rise of dark and cloud kitchens have enabled efficient delivery and cost savings. Millennials, with their preference for convenience and technology, have fueled the growth of this market. Meal delivery times, personalized orders, and AI-driven recommendations have become essential features for customer satisfaction. Healthier meal options, sustainable meal options, plant-based foods, and organic foods are also gaining popularity. The market is witnessing consolidation, with strategic maneuvers and venture capital investments shaping the competitive landscape. Companies like Uber Eats Japan, Cartken, and Mitsubishi Electric are making significant strides in the market. The future of food delivery services looks promising, with innovations like robot food delivery and meal aggregators offering restaurant options and competitive prices. Table of Contents: About Technavio Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios. Contacts

Rappi Frequently Asked Questions (FAQ)

When was Rappi founded?

Rappi was founded in 2015.

Where is Rappi's headquarters?

Rappi's headquarters is located at Avenue Mariano Escobedo, Mexico City.

What is Rappi's latest funding round?

Rappi's latest funding round is Convertible Note.

How much did Rappi raise?

Rappi raised a total of $2.249B.

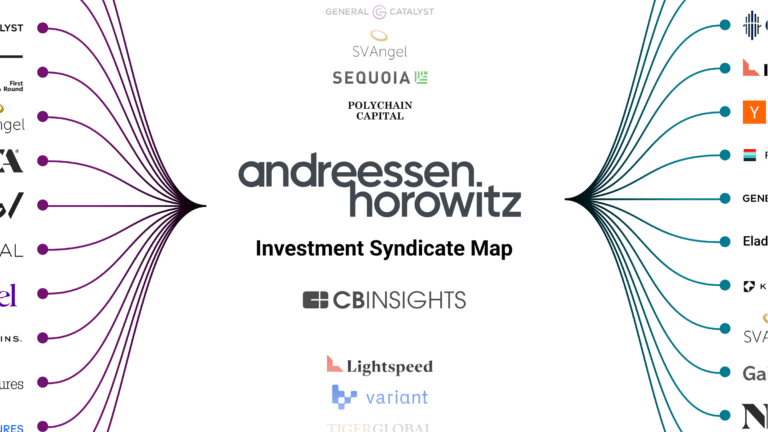

Who are the investors of Rappi?

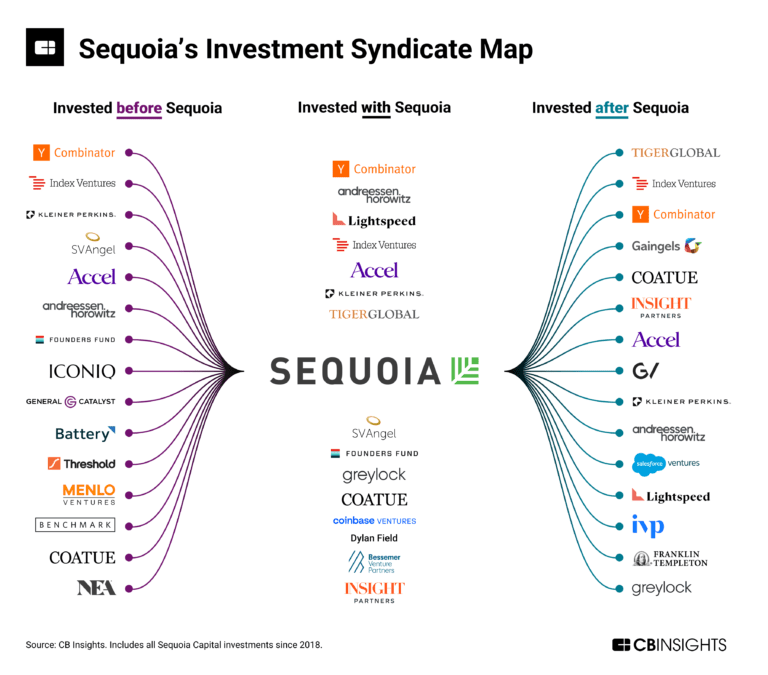

Investors of Rappi include Rockstart LatAm, Sequoia Capital, Andreessen Horowitz, DST Global, SoftBank Latin America Fund and 40 more.

Who are Rappi's competitors?

Competitors of Rappi include Swiggy, Zepto, Gopuff, Instacart, Dunzo and 7 more.

Loading...

Compare Rappi to Competitors

Jokr is a platform specializing in instant grocery and retail delivery. The platform offers a shopping experience, delivering products including groceries, pharmaceuticals, and exclusive local items. The company was founded in 2021 and is based in Grand Duchy of Luxembourg, Luxembourg.

Shadowfax caters logistics platform that operates in the hyper-local, on-demand delivery sector. The company provides a range of services including delivery, retail deliveries, and e-commerce solutions such as forward and reverse shipments. It primarily serves sectors such as e-commerce, food, pharma, and groceries. It was founded in 2015 and is based in Bengaluru, India.

Swiggy operates as an on-demand delivery platform in the food service industry. Its main service is providing a platform for customers to order food online from various restaurants. Swiggy primarily serves the food delivery industry. It was founded in 2014 and is based in Bengaluru, India.

Slice provides technology, data insights, targeted marketing, and collective buying power to help independent pizza restaurants serve digitally-minded customers and grow their businesses. The platform primarily caters to the food service industry, specifically local pizzerias looking to expand their digital presence and reach. Slice was formerly known as MyPizza. The company was founded in 2010 and is based in New York, New York.

DRINKS is a company that focuses on alcohol technology and e-commerce enablement in the alcohol industry. The company offers a range of services including a platform for alcohol e-commerce, a Shopify app for tax and compliance, and a suite of data and analytics products that leverage artificial intelligence to aid in selling alcohol online. These services primarily cater to retailers, brands, marketplaces, and wineries in the alcohol industry. It was founded in 2013 and is based in Los Angeles, California.

Merqueo provides a digital shopping platform for grocery items. Its catalog encompasses multiple products including fresh fruits and vegetables, imported products, liquors, household items, personal care goods, and more. It was founded in 2017 and is based in Bogota, Colombia.

Loading...