Formation Bio

Founded Year

2013Stage

Series D | AliveTotal Raised

$610.3MLast Raised

$372M | 3 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+115 points in the past 30 days

About Formation Bio

Formation Bio is a tech-driven, AI-native pharmaceutical company focused on drug development. The company specializes in acquiring and developing clinical-stage drugs more efficiently by leveraging a proprietary technology platform that incorporates artificial intelligence. Formation Bio primarily serves the pharmaceutical industry by expediting the drug development process for various therapeutic areas. It was formerly known as TrialSpark. It was founded in 2013 and is based in New York, New York.

Loading...

Loading...

Research containing Formation Bio

Get data-driven expert analysis from the CB Insights Intelligence Unit.

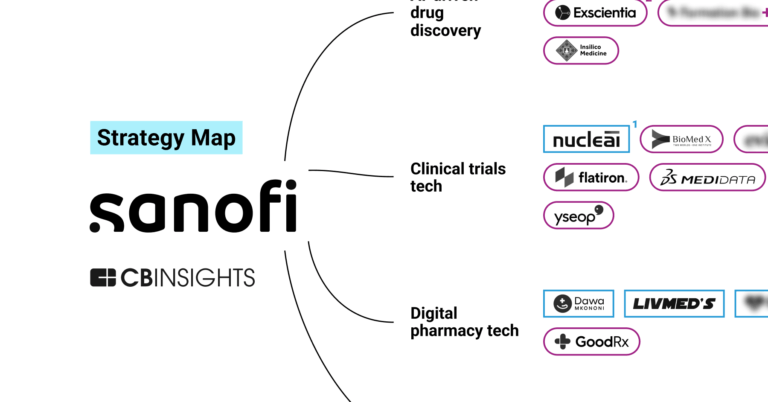

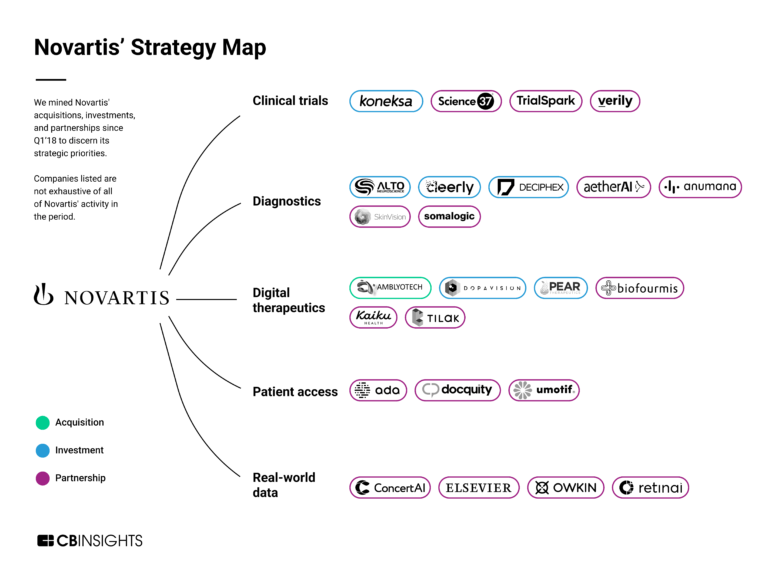

CB Insights Intelligence Analysts have mentioned Formation Bio in 5 CB Insights research briefs, most recently on Jun 27, 2024.

Expert Collections containing Formation Bio

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Formation Bio is included in 2 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Digital Health

11,068 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Latest Formation Bio News

Jul 24, 2024

July 24, 2024 By Bio-IT World Staff July 24, 2024 | Formation Bio raises $372 million in Series D for their AI-driven drug discovery platform; Element Biosciences nets $277 million to launch combined sequencing and cyto-profiling platform; and more. $372M: Series D for AI Expansion and Acquiring Candidate Drugs Formation Bio raised $372 million in Series D funding, led by a16z with significant participation from Sanofi. Other investors include Sequoia, Thrive, Emerson Collective, Lachy Groom, SV Angel Growth, and FPV Ventures. The company takes an AI-enabled approach to drug discovery and clinical trials. The new capital will be used to acquire candidate drugs and expand their AI capabilities. $277M: Series D for Genomics Innovator Element Biosciences secured $277 million in Series D to support its growing global customer base with disruptive DNA sequencing and multi-omics technologies for years to come. The oversubscribed round was led by Wellington Management with participation from new and existing investors, including Samsung Electronics, Fidelity, Foresite Capital, as well as funds and accounts advised by T. Rowe Price Associates, Inc, and Venrock, among others. This funding will support the commercialization of AVITI and the upcoming launch of AVITI24, the first instrument to combine state-of-the-art sequencing and cyto-profiling (mapping cell characteristics) into a single integrated biology platform. AVITI24 revolutionizes research by enabling simultaneous examination of DNA, RNA, proteins, phosphoproteins, and cell structure within single cells. $260M: Series B for Cardiovascular Therapies Cardurion Pharmaceuticals raised $260 million in Series B funding led by Ascenta Capital, with participation from Bain capital Life Sciences and Bain Capital Private Equity. There was also participation from new investors NEA, GV, Fidelity Management & Research Company, Millennium Management, Farallon Capital Management, Invus, Blue Owl Healthcare Opportunities, Delos Capital, and Digitalis Ventures. The funds will be used to support later-stage clinical trials with the company’s two lead drug candidates, a first-in-class phosphodiesterase-9 (PDE9) inhibitor for heart failure and the first clinical-stage Calcium/Calmodulin-dependent Protein Kinase II (CaMKII) inhibitor with broad therapeutic potential. In addition, the funding will be used to expand the cardiovascular indications for Cardurion’s portfolio of drug candidates, to progress internal discovery programs, and to acquire additional therapeutic assets targeting unmet needs in the cardiovascular disease area. $150M: Series C for Identifying Novel Cancer Targets Scorpion Therapeutics closed a $150 million Series C round led by Frazier Life Sciences and Lightspeed Venture Partners, with contributions from Omega Funds, Vida Ventures, Atlas Venture, Abingworth, Fidelity Management & Research Company, Boxer Capital, EcoR1 Capital, LLC, Surveyor Capital (a Citadel company), Invus, Wellington Management, Nextech Invest Ltd. (on behalf of one or more funds managed by it), OrbiMed, Logos Capital, Woodline Partners LP, and Casdin Capital, LLC. Additional new support was also provided by Willett Advisors. The proceeds will be used to advance Scorpion's pipeline of differentiated small molecule oncology programs to expand clinical development of its allosteric, differentiated, mutant-selective PI3Kα inhibitor, STX-478. $150M: Series D for Monoclonal Antibody Trials CatalYm raised $150 million in Series D funding, led by Novartis Venture Fund and Jeito Capital, as well as new investors Canaan Partners, Bioqube Ventures, Omega Funds, Forbion Growth Fund, and Gilde Healthcare. The funds will be used to expand CatalYm’s lead candidate, visugromab, and its late-stage clinical development, including randomized phase 2b studies targeting checkpoint-naive and second-line treatment settings for solid tumors. $122M: Series A for Liver Disease and Pregnancy Trials NGM Biopharmaceuticals announced a $122 million Series A financing led by TCG. NGM Bio will use the proceeds to initiate a planned registrational trial of aldafermin, an engineered FGF19 analog, for the treatment of primary sclerosing cholangitis (PSC), a rare liver disease that irreparably damages the bile ducts, and to complete a planned Phase 2 trial of NGM120, a GDF15/GFRAL antagonist, for the treatment of hyperemesis gravidarum (HG). Both trials are expected to begin in the fourth quarter of 2024. $115M: Series A for Novel Cancer Treatments Myricx Bio raised $115 million in Series A funding, co-led by Novo Holdings and Abingworth, as well as new investors Eli Lilly, Cancer Research Horizons, and British Patient Capital, a subsidiary of the U.K. government’s economic development bank. Founding investors Sofinnova Partners and Brandon Capital also participated in the round. The funds will be used to build out Myricx’s proprietary N-Myristoyltransferase inhibitor (NMTi) antibody-drug conjugate (ADC) payload platform and advance its pipeline of NMTi-ADCs through the proof-of-concept stage. According to Myricx, NMT is an enzyme that can add a lipid modification to several protein targets that are necessary for cancer cell survival. $100M: Series C for Neurodegenerative Disease Therapies Asceneuron secured a $100 million Series C financing to advance the clinical development of its clinical pipeline of OGA inhibitors for the treatment of neurodegenerative diseases. The financing was led by Novo Holdings with new investment from EQT Life Sciences – LSP Dementia Fund, OrbiMed and SR One, alongside participation from existing investors M Ventures, Sofinnova Partners, GSK Equities Investments Limited and Johnson & Johnson Innovation – JJDC, Inc. The financing will be used to advance Asceneuron’s lead asset ASN51 into Phase 2 clinical development for the treatment of Alzheimer’s disease. ASN51 is an oral small molecule drug designed to inhibit OGA, an enzyme implicated in protein aggregation. $82M: Series A for Genomic Medicines Exsilio Therapeutics has closed $82 million in Series A financing. The funding was co-led by Novartis Venture Fund and Delos Capital, with participation from OrbiMed, Insight Partners, J.P. Morgan Life Sciences Private Capital, CRISPR Therapeutics, Innovation Endeavors, Invus, Arc Ventures, and Deep Insight. Exsilio was seed-funded by OrbiMed. The proceeds will be used to advance its genomic medicines based on naturally occurring, programmable genetic elements that can precisely insert new genes into a cell through mRNA intermediates. $80M: Series B for Computational Disease Models CytoReason secured an aggregated $80 million Series B funding from OurCrowd, NVIDIA, Pfizer, and Thermo Fisher Scientific. This investment will be used to expand the application of computational disease models for predictive insights into additional indications, grow its proprietary molecular and clinical data, and establish an office in Cambridge, Mass. later this year. $68M: Series A for Inflammatory Disease Treatments SciRhom has raised $68 million in Series A funds. The round was co-led by Andera Partners, Kurma Partners, Hadean Ventures, MIG Capital, and Wellington Partners, with participation from new investor Bayern Kapital and existing backers including High-Tech Gründerfonds and PhiFund Ventures. The investment will support clinical development of the company's lead antibody candidate SR-878, which is directed against a protein many experts initially dismissed as an improbable therapeutic target. $60.3M: Series B for Gout Treatment GRO Biosciences closed an oversubscribed $60.3 million Series B financing co-led by new investors Atlas Venture and Access Biotechnology, as well as participation from previous investors Leaps by Bayer, Redmile Group, Digitalis Ventures, and Innovation Endeavors. Proceeds from the financing will be used to advance the company’s lead program into the clinic for the treatment of refractory gout, to broaden the GRObio pipeline, and to expand its genomically recoded organism (GRO) platform for scalable production of therapeutics incorporating multiple non-standard amino acids (NSAAs). $37M: Series A for Chronic Hepatitis B Treatment AusperBio has completed a $37 million Series A financing round. This round was led by existing investor, InnoPinnacle Fund, with participation from new investors including Yuanbio Venture Capital, Qiming Venture Partners, Hankang Capital, and Genesis Capital. The proceeds from the financing will further support the clinical development of AHB-137, AusperBio's lead product candidate. Additionally, the funds will advance its proprietary Med-Oligo technology platform and its product pipelines. $35M: Series A for siRNA Programs Development Rona Therapeutics announced the completion of $35 Million Series A+ financing. This round was led by LongRiver Investments, with participation from investors including Zhaode Investment, BioTrack Capital, Zhongqi Capital and Lilly Asia Ventures. Rona will use proceeds to progress leading metabolic siRNA pipeline programs into global development and expand extra-hepatic delivery platform in CNS and beyond. $22.5M: Series B for Commercialization of At-Home Diagnostic Tests NOWDiagnostics raised $22.5 million in Series B financing. Led by DigitalDx Ventures, with notable investors including the Labcorp Venture Fund and Kompass Kapital Management, this oversubscribed funding round will be used to drive the commercialization of at-home diagnostic tests, continue developing new diagnostic innovations, expand the pipeline of tests, and support strategic hiring initiatives. $20M: Series C for Chemoproteomics Platform Frontier Medicines closed an oversubscribed $20 million in Series C funding from ArrowMark Partners and Deep Track Capital. The financing proceeds will support further advancement of Frontier’s FMC-376, a small molecule with a differentiated dual direct mechanism of action targeting both ON + OFF KRASG12C that is currently in the Phase 1/2 PROSPER trial (NCT06244771), and other preclinical/pipeline programs against high-value precision medicine targets. $16.5M: Series A for Customer Relationship Management Platform Courier Health announced a $16.5 million Series A led by Norwest Venture Partners with participation from existing investor Work-Bench. The funding will support continued product innovation and hiring across engineering and sales to bring the company's purpose-built customer relationship management (CRM) platform to more biopharma partners in search of a comprehensive system for coordinating and personalizing the patient journey. $16M: Series A for Oral Therapeutics Holoclara announced the completion of an oversubscribed $16 million Series A financing led by BOLD Capital Partners. Horizons Ventures, Tarrasque, Endurance28, Freeflow Ventures, and a syndicate of leading angel investors also participated in the round. The capital will be used to progress development of Holoclara’s orally available therapeutics into the clinic this year. The company additionally continues to advance its broader discovery engine to isolate and identify molecules with therapeutic potential from worms.

Formation Bio Frequently Asked Questions (FAQ)

When was Formation Bio founded?

Formation Bio was founded in 2013.

Where is Formation Bio's headquarters?

Formation Bio's headquarters is located at 16 East 34th Street, New York.

What is Formation Bio's latest funding round?

Formation Bio's latest funding round is Series D.

How much did Formation Bio raise?

Formation Bio raised a total of $610.3M.

Who are the investors of Formation Bio?

Investors of Formation Bio include Thrive Capital, Sequoia Capital, Lachy Groom, Emerson Collective, SV Angel and 17 more.

Who are Formation Bio's competitors?

Competitors of Formation Bio include Virgo Surgical Video Solutions, Biorce, Inato, Curebase, Saama Technologies and 7 more.

Loading...

Compare Formation Bio to Competitors

Castor is a medical research data platform. It provides decentralized clinical trial solutions to control clinical trial design. It analyzes, manages, and organizes medical data collected from multiple electronic records. The company was founded in 2012 and is based in New York, New York.

Reify Health is a company focused on improving the clinical trial process within the healthcare industry. The company offers cloud-based software that accelerates patient enrollment in clinical trials, thereby facilitating the development of new therapies. Reify Health primarily serves the healthcare and biopharma industries. The company was formerly known as ZeroSum Health. It was founded in 2012 and is based in Boston, Massachusetts.

Lindus Health is a clinical research organization that specializes in accelerating clinical trials for life science companies. The company offers full-service trial management, including study design, patient recruitment, clinical data capture, and project management, leveraging technology and access to electronic health records to streamline processes. Lindus Health provides fixed-priced quotes with milestone-based payments, aiming to deliver clinical studies up to three times faster than traditional CROs. It was founded in 2021 and is based in London, England.

Medable specializes in providing digital clinical trial software solutions within the healthcare and pharmaceutical sectors. The company offers a comprehensive platform that facilitates the management of clinical trials, including tools for remote data collection, electronic consent (eConsent), patient-reported outcomes (ePRO), and clinical outcome assessments (eCOA), all designed to streamline the trial process and enhance data quality. Medable was formerly known as Dermatrap. It was founded in 2012 and is based in Palo Alto, California.

BloqCube is a software company specializing in decentralized clinical trial management and financial systems. The company offers an integrated Clinical Trial Management & Financial System (CTMFS) platform designed to accelerate Decentralized Clinical Trials (DCT) by providing a secure, transparent, and efficient way to manage trials and handle financial transactions. BloqCube primarily serves the healthcare and pharmaceutical sectors by streamlining clinical trial processes and financial management. It was founded in 2017 and is based in Piscataway, New Jersey.

Curebase provides a range of software tools designed for clinical trial recruitment, consent, and data collection processes. Curebase primarily serves the clinical research industry, including CROs, research sites, and study participants. The company was founded in 2017 and is based in San Francisco, California.

Loading...